Discover what drives your aspirations

Transform to Everyday Banking Partner that customer can rely on

Simplify onboarding, drive more transactions, and enable seamless various QRIS payments.

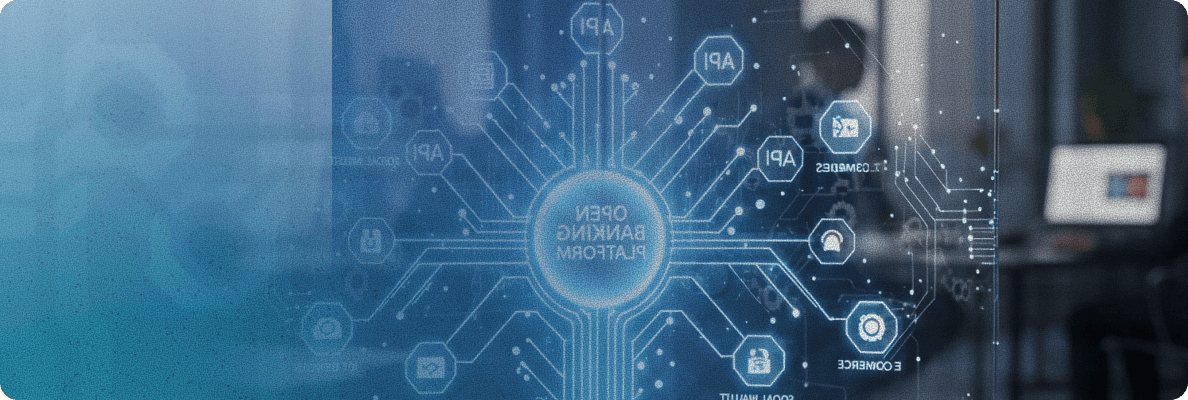

Bring Your Banking Services Into Every Digital Ecosystem

Simplify integrations with secure, standardized APIs that connect partners, extend your reach, and unlock new revenue streams.

Empowering Merchants to Compete in the Digital Economy

Enable merchants and MSMEs to manage sales and payments digitally, and unlocking new revenue streams for your bank.

Explore Our Products Suites

Digital Banking & Financial Suite

Digital Core

Core-agnostic and powerful X-MiddlewareTM as orchestration layer towards “dual” core banking system, enabling multi-proposition and hassle-free migration. Proven experience with prominent CBS, i.e. BankVision & Sunline.

Mobile Banking

All-in-one mobile banking application solution, NexaTM is designed and equipped with eKYC on boarding system, promo engine, biller system, and notif engine. Built over native Android and iOS. Option to hybrid e-wallet on boarding available.

Open Banking

Scalable and secure VeroTM Banking as a Services solution, enabling developers & partners access to your financial services. More 50+ SNAP-complied API available. Equipped built-in API gateway or connect with legacy gateway.

Corporate Banking

Enable your customer's business operation with our BokraTM corporate solution set. A powerful cash management and supply chain financing system, with comprehensive features to corporate customers and business owners.

Acquiring platform

Highly scalable QRIS acquiring solution, xxxxTM with market-leading processor handling millions of daily transaction. Experienced implementation to all 4 switchings, with most complete QRIS use cases available : MPM, CPM, Tap, TITO, CICO, CBOP, CPTS.

Digital Loan

Managing loan origination, underwriting, disbursement, collection and portfolio management are never been easier with our xxxTM Digital Loan solution. With multi products capabilities, from KTA, KUR, Channeling, PayLater, and KPR.

Fraud Detection

Omni-channels fraud detection solution, supporting pre-mode and post-mode, rule based validation. Fund tracking and custom models using machine learning add-on capability is available.

Payment Platform

A unified payment platform that delivers seamless, secure, and real-time transactions through BI-Fast, virtual accounts, All type of QR & digital goods payments, and cardless cash withdrawals.

Managed Services

All-in-One Managed Services

Expand your business massively with market leading and comprehensive managed service solution, ranging EDC, ATM, Branch IT, and Contact Center.

DevOps & DBA

Streamline your infrastructure and DB management with top notch DevOps and DBA managed services.

Billing Management

Streamlined Billing

Digitalize the way your customers pay the invoices, with flexible options and immediate settlement fits your business.

Engagement & Data Management

Super App

Make over or build your new customer app over mobile, with our NexaTM solution. Give best experience over modern and customized visual and UI design. Provided with integration to tracker, marketing platform, and CDP as option.

Data Analytics

Our Banking Analytics Suite, leveraging Machine Learning and AI, empowers you with descriptive, modelling and predictive analytics, campaign editor tool, and ranges of analytical services.

Privacy Data Management

Empower you to manage your sensitive data, ensuring compliance with privacy regulations, controlling data access, and maintaining transparency in how personal information is collected, stored, and used.

Loyalty Rewards

Loyalty Rewards

Start to retain your customers and drive engagement with our NaraeTM customer loyalty solution. Open API, web, or even stand alone mobile application, with multi rewards proposition: voucher, points, stamps and gamification.